President Barack Obama at a Town Hall meeting in North Carolina this week challenged his audience and the inventors of the United States to alert him to any technologies of an alternative kind that have the promise of reducing our dependence on fossil fuels and foreign oil.

I know only too well that alternative technologies are working and available now, or need just a small amount of help to become alternatives to the products that are suffocating our planet and driving the violent global strategies of superpowers and oil companies alike.

Here is a comprehensive discussion of two that are ready to go, Mr. President

There is one, and only one, answer to America's burgeoning national debt, now in the many trillions of dollars and seemingly impossible to repay. There is a way - and also a means - and both can be summed up in one word each. The first is prosperity.

What happens when individual American suddenly once again have cash in their pockets, jobs to go to, and money in the bank? If the prosperity endures for any length of time, debt begins to fall as tax revenues grow. So what is the word that is going to make that happen? Well, there was a different word that made it happen in the Clinton Administration: Internet.

The Net exploded on the world scene in 1994, when a clever man by the name of Tim Berners-Lee created the first Internet browser, called Mosaic. With the advent of Mosaic, email - pretty much the only widely accessible function then - were overtaken by the advent of Internet graphics.

With HTML encoding, such as I do by hand for every edition of The American Reporter (we don't use anyone's templates) the power of the Internet immediately began to emerge. By the turn of the century, revenues from all Internet operations closed in on $1 billion. By the end of the past decade, advertising revenues alone reached $23 billion.

But even in 1999, according to an otherwise flawed report by the University of Texas McCombs School of Business in Austin, jobs traceable to the Internet had gone from the dozens in 1993 to 2.67 million by 1999. Oh, what a little invention can do!

Because of the Internet, President Bill Clinton could leave a $127 billion surplus in 2001 for the Bush Administration to squander (it was all gone by 2003). By 2005, Bush was running a budget deficit of $519 billion, according to Bloomberg News. So the question becomes, "Where can President Obama find another Internet?" He doesn't have to look far. But he may have to ignore the Dept. of Energy.

That's the second word: energy. Back in 1988, "cold fusion" and its discoverers, the late Dr. B. Stanley Pons of the University of Utah and English chemist Dr. Martin Fleischmann, were being tarred and feathered for their claims by both the media and fellow scientists. A "60 Minutes" segment in November 2009 would later rehabilitate them and their theory, which now has been replicated at least 2,000 times.

But in April 1989, one observer was just a few steps outside the fray. Soon he, too, would be disparaged, but never on the same scale. His name is Dr. Randell C. Mills, a graduate of Harvard Medical School who'd been encouraged by a mentor there to study bioengineering at nearby MIT. Some of our readers were not yet born when Drs. Pons and Fleischmann were branded as fools, so let me recount a little of what happened.

On March 23, 1989, the day before the 10.8-million-barrel Exxon Valdez oil spill on the pristine shores of Alaska's Prince William Sound, Pons and Fleischmann held a press conference. Even as a number of universities and other laboratories rushed to claim the same achievement first, they told the press in Salt Lake City that they had produced "tabletop" or "cold" fusion, i.e., that they had harnessed the power of the sun. And not in a hugely expensive magnetic bottle, as physicists expected to do some day, but in a couple of plain glass vessels on a laboratory countertop in the chemistry building at the University of Utah.

Pons and Fleischmann declared that during simple electrolysis, using palladium as the anode and deuterium, or heavy water, as the electrolyte, the reaction to an electric current was demonstrably emitting far more energy in the form of heat than conventional chemistry could account for.

For five years starting in 1983 they had labored to do this, and just as other labs threatened to beat them to a patent, the university, Fleischmann says, pushed them to held the press conference in advance of publication of their paper on the topic in the obscure but peer-reviewed Journal of Electromagnetic Chemistry. The story was a huge one, making headlines across the entire world; the Valdez story was on the front page with it.

The irony in that has escaped most historians, but they together created a tale of breakthrough and disaster that could be a great tragedy, if well-told, because in the seeds of cold fusion is the death of Big Oil.

But the Pons-Fleischmann claim was more immediately and profoundly threatening to a group of well-funded physicists whose careers were buttered with tens of billions of dollars in federal funding for their fruitless hot fusion projects, such as the Tokomak reactor. To date, none of this funding - perhaps $50 billion worth so far - has produced a working hot fusion reactor or saved an American consumer a single cent. Return on $50-billion investment: zero.

The advent of a simple, cheap, competing technology, if it were allowed to stand, would be absolutely ruinous, these men knew. They didn't wait to publish, either. Instead, with a poor understanding of what occurred in Utah, they rushed through attempts at replication. Instead of the lengthy times needed to allow the palladium lattice to absorb a high ratio of deuterium, they invariably tried to get the reaction the Utah scientists did quickly and easily - and it didn't happen. NASA scientists later criticized the would-be replicators harshly for flawed and "hurried" experiments.

Meanwhile, new billions of taxpayer dollars were in the pipeline for all kinds of hot fusion studies and projects. Their spokesman was Bob Park, the president of the American Physical Society and a columnist for the society's prestigious scientific journal, Physical Review. His "What's New" column relentlessly attacked cold fusion and its discoverers, and later Randell Mills. According to the Village Voice, he actually lied on at least one occasion about Mills' work. And his column told the world acupuncture didn't work, that Jesus Christ was an "itinerant healer," and - ever the breathless insider - that the North Koreans couldn't build an ICBM - on the day before they successfully launched one.

By early May, just weeks after they announced their discovery, Dr. Park and the APS took their anti-cold fusion show on the road. On May 9, less than two months after their announcement, Malcolm Browne of the New York Times wrote, "Top physicists directed angry attacks at Dr. Pons and Dr. Fleischmann, calling them incompetent, reciting sarcastic verses about their claims and complaining that they had refused to provide details needed for follow-up experiments. A West European expert said 'essentially all' West European attempts to duplicate cold fusion had failed." He was one of hundreds of science writers who felt betrayed and embarrassed by their initial reports, and some - like Thomas Maugh of the Los Angeles Times, who first report I read, would never touch the subject again.

The denunciations came as Dr. Pons was actually in Washington, getting ready to meet with President George H.W. Bush and ask for $25 million for further study of cold fusion. Very quickly, long before any serious effort at replication could be mounted, the tide was turned. It was awful to watch, especially for those whose hopes for a pollution-free future had risen so far. Later, when a new patent had already been published in the Gazette of the U.S. Patent Office, a "poison pen" call from Bob Park to friends at the patent office got the patent grant to Mills reeled back in and then denied.

By himself, Park has probably saved the oil industry twice, and cost Americans countless billions of dollars in cheaper energy costs they could have enjoyed. But more about that shortly.

One scientist who joined Park in denouncing the hydrino theory of Randell Mills, way back in 1999, was physics Nobelist Dr. Steven Chu. Today he is Secretary of Energy. Despite the validation of cold fusion - now called LENR, for Low Energy Nuclear Reaction - and the laudatory revelations of the November 2009 "60 Minutes" piece and groundbreaking presentations at the March 26, 2010, convention of the American Chemical Society, Chu is not parting with money for more research. The Dept. of the Navy and a private form had to finance the latest study.. But Mills has not sought government or Wall Street equity money, and has raised $71 million on his own.

Chu and Park have one thing in common: the craftiness to disable the rise of a new scientific theory just at the point when the public might demand action to implement it and save them from the endless billion of expense that go to fuel and electric power. Park's lightning strike on Pons and Fleischmann came just as a meeting with the President was about to give them the green light; Chu's came just as Randell Mills was ready to take public his plan to change the way the world used the energy of hydrogen.

"It's extremely unlikely that this is real, and I feel sorry for the funders, the people who are backing this," Chu told the Wall Street Journal's Dow Jones News Service in 1999, when Mills results' were being validated by America's national laboratories, major universities and NASA.

But scientists are catching up with these two deft dodgers. At the March 26 meeting of the American Chemical Society, for instance, Michael McKubre, director of SRI International's Energy Research Center in Menlo Park, Calif., told National Public Radio's "Science Friday" program about an American company in Israel, Energistics Technologies, has recently demonstrated a 25-fold increase in energy after putting 40 Joules of heat into their cold fusion process and getting 1.47 megaJoules out.

"We're seeing thousands or tens of thousands of times more energy than can be explained by any form of chemistry that I'm familiar with," McKubre told NPR. "If you could do that every time with cheap materials and no dangerous byproducts, that is a practical technology. That is commercializable, just there," he said.

As impressive as they are, the Energistics results from a cold fusion process pale in comparison to those from Mills' hydrino reactors. The inventor of the hydrino process rejects quantum mechanics and its relativistic in favor of concrete, classical physics that yield hard, clear, testable numbers. That has divided and re-divided the world of physics as some have hardened their position against Mills, some have moved from skeptical to undecided, and others have joined his camp.

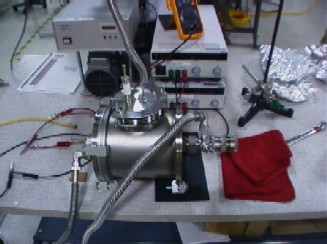

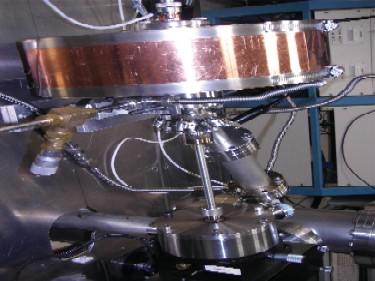

But Mills already has 20 working 50- and 75-kilowatt reactors at his plant in Cranbury, N.J. (not far from where both Einstein and Edison worked), and big-name venture capitalists have so far backed him to the tune of $71 million. You might coin a new adage" in the field of high-energy physics: "One working self-regenerating reactor is is worth all the theories of quantum and classical physics combined."

The former CEO of Westinghouse and a former USAF chief of staff sit on his company's board. Meanwhile, the relativistic theories of quantum mechanics have met their match in Mills' unified model of classical and quantum theory, in that his devices work - and have about $700 million in contracts awaiting roll-out. The latest came from a sprawling Italian multinational, the RadiciGroup, which ordered a 750MW hydrino reactor to power all the Group's industrial and corporate facilities in a deal announced on March 19.

So what is the savior of the economy? Either, or both, cold fusion and hydrino reactors, have much but certainly not all in common. Both could - by virtue of their relatively low cost and cheap materials, as well their lack of need for fuel other than water, not to mention their emission-free operation - transform our manufacturing base, our employment picture, our state and federal tax revenues - and our lives and burdens - almost overnight. These are technologies that work now and can be implemented now. With real leadership in Washington, we could be self-sufficient in energy two years from now, and free of fossil fuels in a decade.

And like the Internet once did, they can save the American economy this time for good. And now there is a greater imperative than there has ever been to adopt and fund them: without such a boon, we will become bankrupt nation, unfathomably deep in debt to China and other trading partners. Those in power have a hard, cold choice: take what the good Lord has given us in these new technologies, and abandon those that have polluted this lovely planet, or die as other civilizations have, in debt, desolation and disgrace. Those are choices that separate the real patriots from the flingers of rhetoric and defenders of the status quo.

Too many people presume that putting the oil industry out of business would be a terrible thing. That's not true. With a new source of electricity that is pretty close to free, hundreds of thousands of small businesses would spring up overnight, both to replicate the technology under license and to develop new applications for it. In turn, that would stimulate jobs for hundreds of thousands of well-educated engineers and millions of people who will assemble these devices from newly-manufactured parts.

Hydrino vehicles, according to the latest "concept car" from BlackLight Power, Mills' company, will get 1,500 miles on a single liter of water. Not only would automotive design soon be back in a big way, but motorists - not needing any more fuel than 50 gallons of water for the life of the car - would have tens of billions of extra dollars in their pockets as they put the automakers back to work, and add billions to that from cheap residential electric and heating costs.

Just two words: Energy" and "prosperity." The economy, sans Big Oil, will renew and replenish itself overnight if the vast inventive capacity of America is allowed by the Obama Administration to put itself to work again. Even Republicans could vote for that.