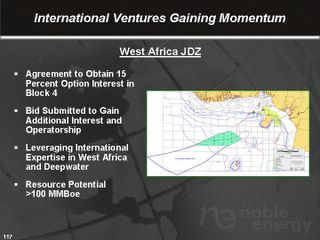

Agreement to Obtain... ?" Why did this Noble Energy PowerPoint presentation on the international aspects of its oil business say that it had an "agreement to obtain" what was apparently 60 percent of ERHE's 25 percent option interest in Block 4? Has our option been sold to Noble Energy? Right-click the picture and select "Open Link In New Window" to see a larger version.

The troubling issue raised by Noble's slideshow is that it makes it appear that ERHC Energy has sold its lone asset in Block 4 and failed to report the sale to shareholders.

It is possible, however, that someone unskilled in writing mischaracterized the arrangement, which according to previous reports involved a Memorandum of Understanding for Noble Energy to exploit the acreage we would win jointly in a bid based on ERHC Energy's underlying option.

Indeed, a clarifying post by kobiashi2000 makes this very point, but it remains a supposition on his part as ERHE and Noble Energy have never issued a formal statement about the details of of our relationship.

Kobiashi says the 15 percent figure mentioned represents what we paid Noble Energy to "farm in" to the block, and that we will participate in the revenues from the remaining 10 percent and "possibly" from the additional acreage we won in Block 4, where our consortium has an 65 percent operating interest.

There is no evidence of that, either, but we also think it's true.

Trading Updates, 6:09pm, 7/1/05:: Dramatic changes occurred in the late hours of trading today, with ERHE's share price shooting up as high as $0.47 before falling back to close $0.015 down - after 150,000 day-trader shares sold in the last five minutes, per the ADVFN network - at $0.42 Friday afternoon. The closing volume topped 3,570,000 shares.

Our trademarked dictum, that big price changes in ERHE tend to occur on three-day weekends, was once again validated, as it was at the close of the Memorial Day Weekend and the preceding three-day holiday.

But what does the drama have to do with the news? That is our question, and as so often happens, there is no ready answer. Posters on the major ERHE boards offered end-of-quarter, exhaustion-of-seller, single-buyer and other ready theories, but to this observer there seems to be far more to the issue than those explanations offer.

We need to keep our eyes peeled for news over the weekend and on Monday's holiday.

We also want to wish all our readers a very Happy Fourth of July. This great country and its wonderful freedoms have made it possible for all of us to prosper if we play our cards right, and we must be grateful to all of those who fight for it, whether on the battlefields of Iraq, the precinct houses of the South Bronx, the firehouses of New Hampshire, the county courthouses of the Deep South or the halls of Congress. And we would be especially remiss today if we did not honor and celebrate the great and wise career of Associate Justice of the Supreme Court Sandra Day O'Connor, whose independence, intelligence and caring for America have guided her through a tempestuous two decades of court decisions, never faltering in her plain and strong love for our sacred Constitution. We disagreed with her on issues like the 2000 election and many others, and she voted against us in our successful appeal to the Supreme Court in 1997, but we can praise a great American lady and an honest, insightful jurist. May God bless her in her well-deserved retirement.

Trading Updates, 1:50pm, 7/1/05:: The price is $0.40 after dipping to $0.395, now the Bid, with the Ask still at $0.40 and volume reaching 2,302,831 shares. The low for the day remains $0.38.

Trading Updates, 1pm, 7/1/05:: We are down $0.04 or 8.05 percent today, to $0.40, the Ask, with the Bid at $0.395. Volume is a healthy 2,076,381 shares.

No comments:

Post a Comment